Key Takeaways

-

- E-BIKE Act Explanation

Learn what the E-BIKE is, why it’s back on the floor again, and whether it will become law in 2024. - Anticipated Tax Savings

Explore how the E-BIKE Act proposes a 30% tax credit (up to $1,500) for an e-bike purchase. - Public Opinion Overview

Get the inside scoop about what urban residents actually think about the E-BIKE Act, thanks to proprietary data from our eBikes.org survey. - Eligibility Simplified

Understand the proposed qualification criteria for the tax credit to discover what e-bikes meet the requirements. - State-by-State E-Bike Incentive Breakdown

Discover which U.S. states are already on board, providing additional rebates and incentives for e-bike enthusiasts.

Maybe you’ve been drooling over buying an e-bike of your own for a while now, or perhaps you’ve been waiting for the perfect time to upgrade your ride (still drooling, though). Well, we’ve got some fantastic news for you. With the reintroduced E-BIKE Act gaining traction, that machine you’ve been undressing with your eyes may soon be within your grasp.

We’re here to dive deep into the intricacies of the e-bike tax credit and act, providing you with a glimpse of what the future might bring.

Let’s get to it, shall we?

If you want a breakdown of the state e-bike initiatives, jump down to our list.

Understanding the E-BIKE Act

The Electric Bicycle Incentive Kickstart for the Environment (E-BIKE) Act proposes a tax credit for buying an electric bike, similar to the existing tax credit for electric vehicles.

This piece of legislation has recently turned heads — for a second time.

A Bit of Background

Representative Jimmy Panetta, backed by 30 cosponsors, first introduced the E-BIKE Act to the House of Representatives in February 2021. Senators Brian Schatz and Edward Markey followed suit in July 2021, proposing the act to the Senate. Unfortunately, both chambers of Congress read the act and deferred it to sub-committees. No further action was taken before the term ended in 2022.

In other words, the bill died in the subcommittees, as most do.

It might be for the better, though, because those same members of Congress (with the support of several more cosponsors) introduced a new and improved version of the E-BIKE Act in March 2023. Again, the act has been introduced and deferred to subcommittees, but we still have until the end of 2024 for the act to move forward.

The Uncertain Future of the E-BIKE Act

The improved terms, added cosponsors, and overwhelming public support have us hopeful the new version of the E-BIKE Act will pass into law this year. However, we must keep a realistic outlook given the limited effectiveness of the 2023-24 Congressional term. There were only 34 laws passed in 2023, an all-time low. It isn’t just the E-BIKE Act that has been pushed aside; it’s most of the proposed legislation.

As of February 2024, both the Senate and the House of Representatives versions of the E-BIKE Act are still sitting in ‘introduced’. We probably won’t see the bill become law this year.

Hope isn’t lost, though! This is the second time the act has been presented, meaning our state officials are serious about it. To give you an idea of the growing support, the House of Representatives bill now has a total of 43 cosponsors from 20 different states and Washington, D.C. The Senate’s version has more than quadrupled its cosponsors, now boasting support from six states.

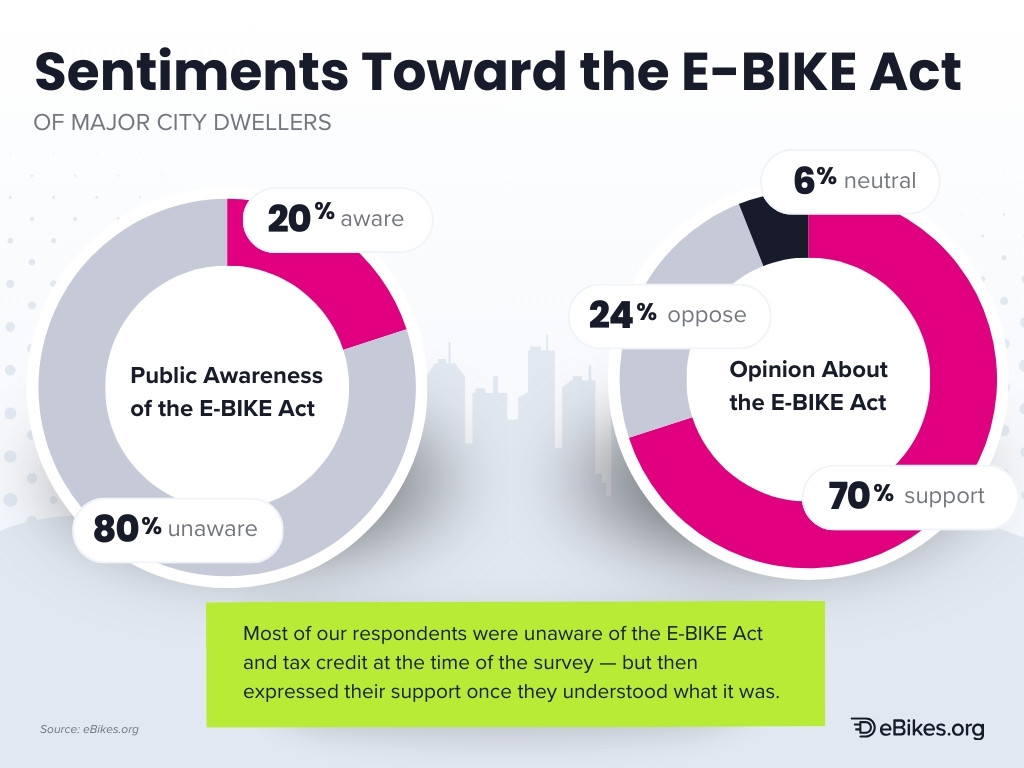

Several major organizations endorse the bill, including PeopleForBikes and the Natural Resources Defense Council. The public has also shown extreme interest in the E-BIKE Act. Our recent eBikes.org survey showed overwhelming support for the bill — although most weren’t aware of it prior to the survey.

If it doesn’t pass this year, the E-BIKE Act will likely appear on the floor yet again during the next congressional term. With growing awareness of the bill and the recently approved EV tax credit, its chances of passing only increase.

It’s less of a question of whether the E-BIKE Act will pass but when.

What Is the E-Bike Tax Credit?

The e-bike tax credit is the heart of the E-BIKE Act. If the bill passes, it would allow taxpayers to get a 30% tax credit (up to $1,500) on a qualified e-bike purchase.

The Multifaceted Importance of the E-Bike Tax Credit

The E-BIKE Act clearly states its legislative purpose: to establish a tax credit for electric bikes. But this bill’s influence extends beyond just a new tax incentive.

Environmental Benefits

The E-BIKE Act represents a transportation and environmental revolution, one that could help people boost the quality of living for entire communities. Representatives Thompson, Blumenauer, and Panetta have made this clear in their conversations about the proposed bill, citing it as a great way to encourage more people to use e-bikes for the betterment of society.

As Blumenauer puts it, “By burning calories instead of fossil fuels, we can make our communities healthier and more livable.”

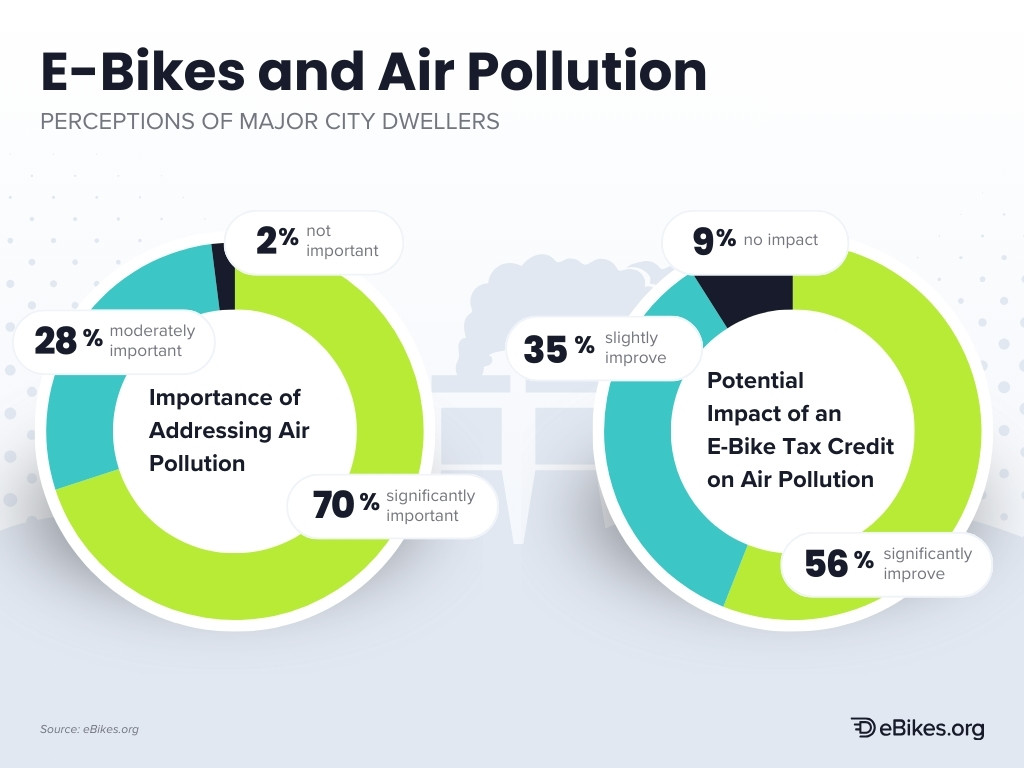

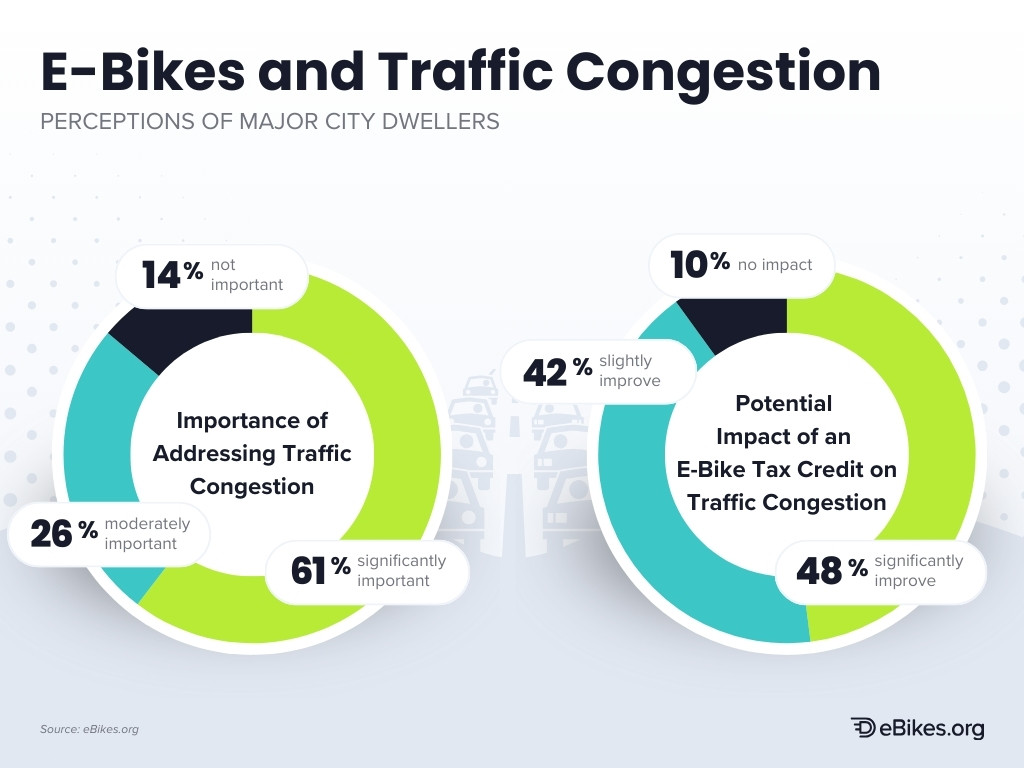

Many urban residents already recognize the benefits of biking to work. Our eBikes.org survey found that nearly two-thirds of major city residents agreed that air pollution reduction was vitally important, and, more importantly, about half believed the E-BIKE Act would help improve both air quality and traffic congestion.

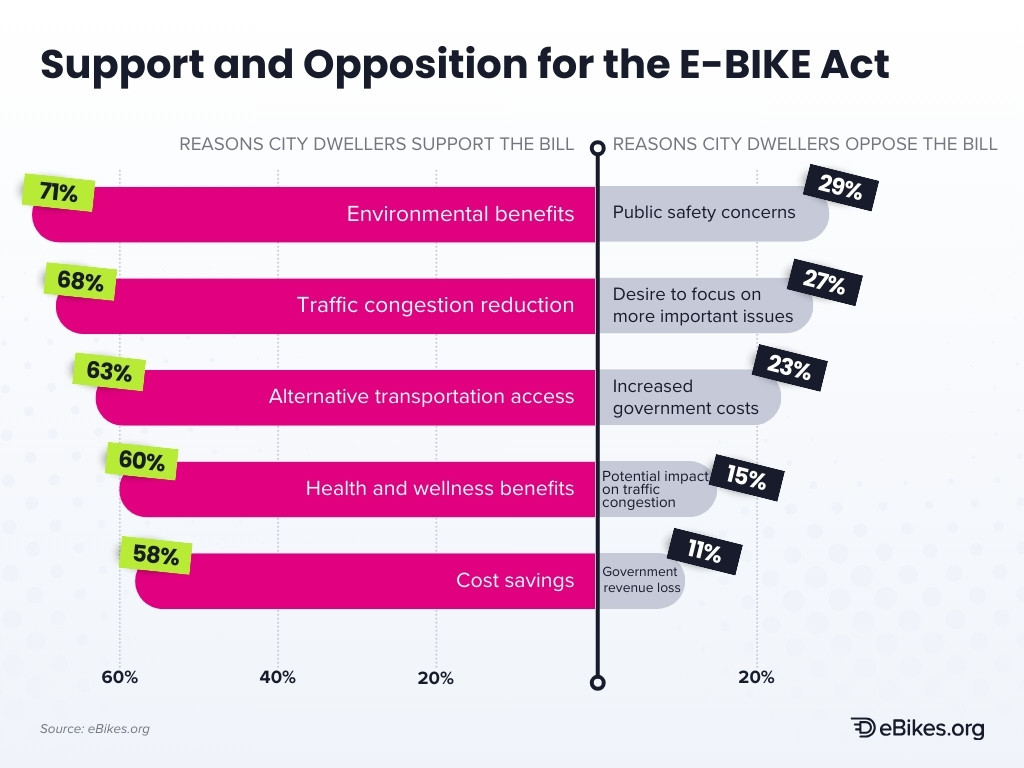

In fact, environmental benefits and traffic congestion reduction ranked as the top two reasons people support the E-BIKE Act. Health and wellness benefits, along with cost savings, followed closely behind.

Financial Benefits

While cost savings ranked fifth, they’re still a critical consideration for urban residents. Nearly 60% of our respondents marked it as an influential factor when deciding whether to support the E-BIKE Act — and understandably so.

The move to electric transportation has a fairly high price tag — one that’s out of reach for many individuals. While e-bikes are already more budget-friendly than electric cars, the proposed e-bike tax credit makes zero-carbon transportation all the more affordable for the U.S. population.

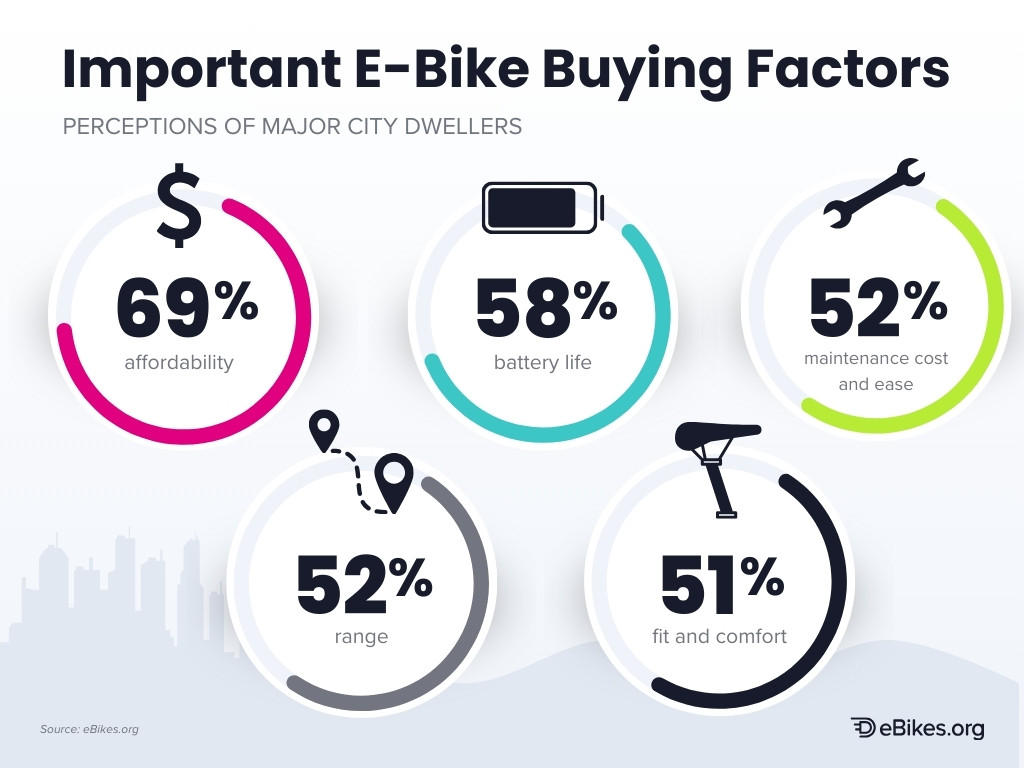

When contemplating an e-bike purchase (not just the overall impact of the tax credit), our eBikes.org survey participants ranked affordability as the number one consideration. Nearly 70% of respondents cited cost-effectiveness as a critical factor, ranking it far above things like battery life, easy maintenance, range, and comfort.

If the e-bike tax credit becomes law, it can help make e-bikes considerably more accessible.

But is the $1,500 maximum enough?

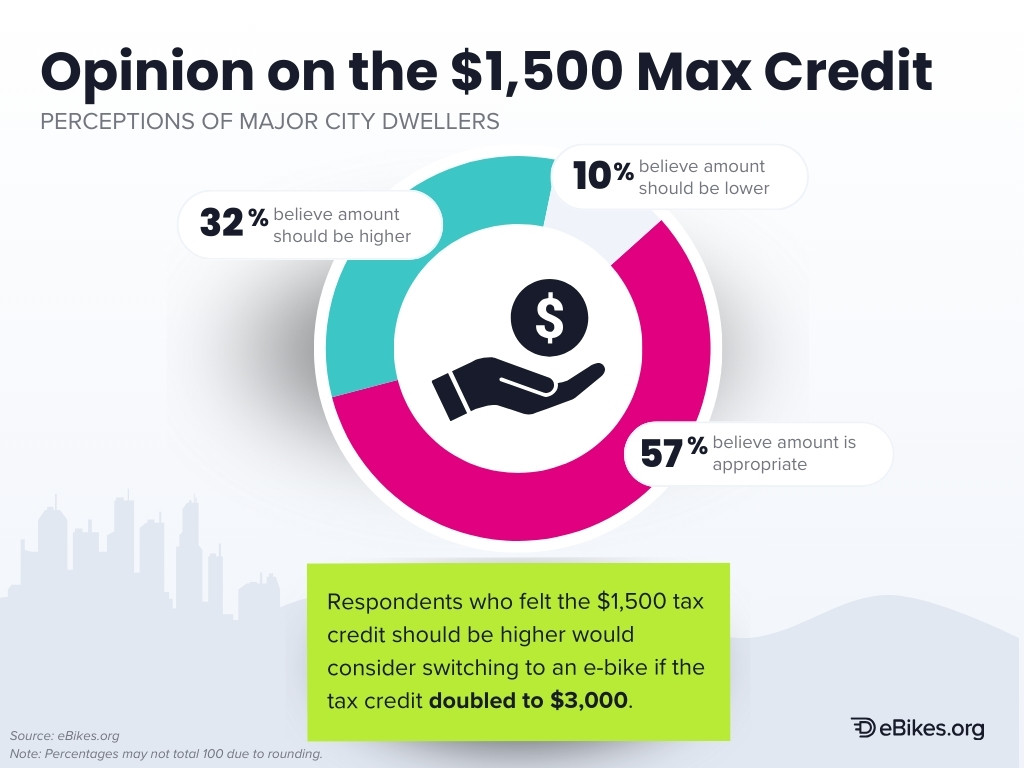

Public opinion on this is divided. Just over half of our survey respondents said the $1,500 maximum is appropriate, while 32% wanted it to be higher. Those looking for a higher credit said they would consider switching to an e-bike if the tax credit doubled to $3,000.

The entire point of e-bike tax credits is to encourage people to switch to an e-bike, so a higher incentive might be more effective — but much harder to approve in Congress.

Public Support for the E-Bike Tax Credit

As mentioned above, most urban residents expressed support for the E-BIKE Act. But how committed are they? Is this just lukewarm support, or are people truly ready to see an e-bike revolution?

Based on our survey data, people truly want to see change in their cities.

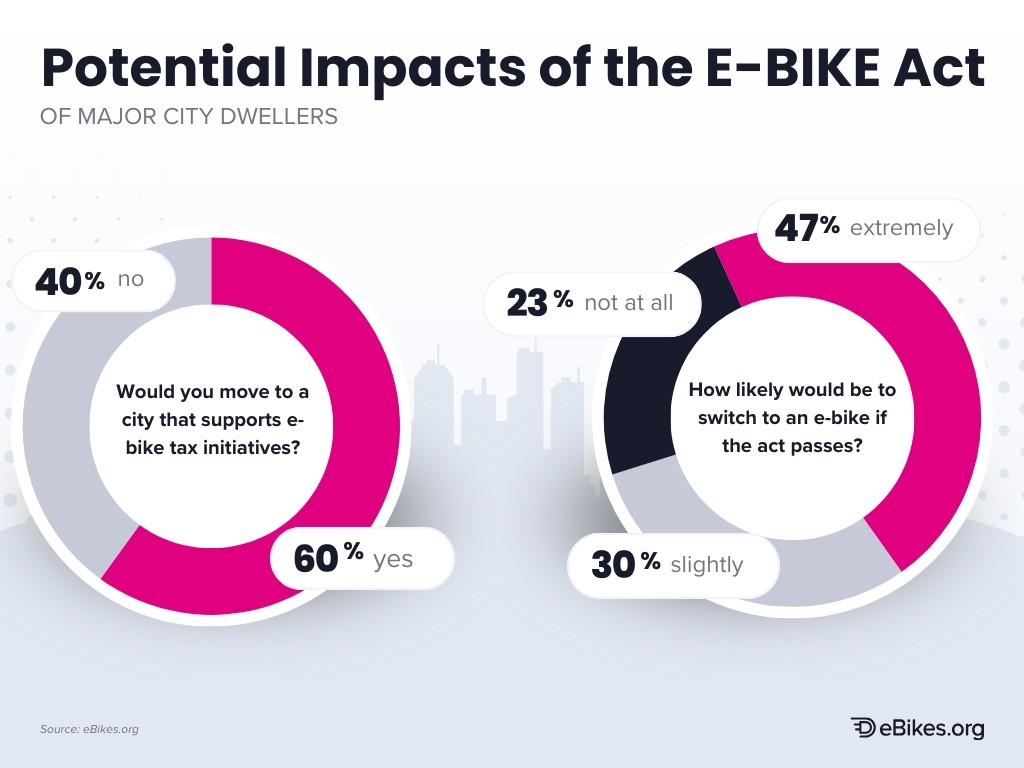

Nearly half of our respondents would switch to an e-bike if the tax credit passes, and 60% of cyclists said they would relocate to a city that supports e-bike tax incentives. That shows incredible commitment to a greener, zero-carbon future.

How to Qualify for the E-Bike Tax Credit

If this version of the E-BIKE Act passes, eligibility will depend on two things: income and e-bike purchase.

Income

The 2023 E-BIKE Act outlines an income-based phase-out plan that would lower the refund amount for high-earning households. It proposes a $100 reduction for every $1,000 over the modified adjusted gross income limits. These thresholds would be as follows:

- $150,000 for individual tax filers

- $225,000 for head of household filers

- $300,000 for joint return or surviving spouse filers

Here’s an example. Let’s say you’re an individual taxpayer whose modified adjusted gross income totals $155,000 — or $5,000 over the limit. You would get a $500 reduction on your refund.

Of course, if you make significantly more than the established limits, the reductions would leave you with no tax refund. The good news is that the credit amount would be based on the modified adjusted gross income for the tax year in question or the year before — whichever has a lower income amount. This provides some wiggle room, allowing taxpayers to get the maximum credit possible.

E-Bike Purchase

Let’s break down the specifics of which e-bikes would qualify for the tax credit.

According to the bill, a qualified e-bike refers to either a new bicycle or new tricycle that costs no more than $8,000 (sorry, hard-core eMTB riders) and falls into one of the three e-bike classifications: Class 1, Class 2, or Class 3. The bike must also include the following:

- Working pedals

- Rider seat

- Only one electric motor of 750W or less that doesn’t go over 20 mph (or 28 mph in pedal assist)

- UL-certified drive system or battery

- Qualified vehicle identification number from qualified manufacturer

Despite the many stipulations, there are still dozens — if not hundreds — of e-bikes that meet those standards. If (or, more optimistically, when) the bill passes, you still have plenty of options to choose from to get that tax credit.

Limitations on the E-Bike Tax Credit

Besides the eligibility requirements, there are several limitations to consider.

First, each taxpayer would receive a credit on only one qualified e-bike every three years. Joint filers would qualify for two e-bike credits over that same three-year period.

The bill would also restrict e-bike use, explaining that taxpayers must purchase the e-bike for their personal use, not resale. People would also be unable to claim depreciation on the e-bike, even if they use it for a trade or business.

The Differences Between the 2021 and 2023 E-Bike Tax Credits

While the latest version of the E-BIKE Act closely resembles its 2021 predecessor, it introduces several major changes. Just at first glance, the 2023 version is much longer, reflecting a much more detailed approach.

Tax Credit Amount and Wording

The first significant difference appears with the dollar limitation. In the 2021 version, the bill explicitly proposes a maximum credit of $1,500 ($3,000 for a joint return). The 2023 version doesn’t specify a maximum credit. Instead, it caps the applicable e-bike cost at $5,000.

Yes, this is confusing, especially with the e-bike cost limit set at $8,000.

This update is basically a more discreet way to cap the refund amount at $1,500. Even if the bike costs $8,000, only $5,000 of that amount would count toward the 30% credit. If we do some quick math, 30% of $5,000 equals $1,500.

In addition to this new wording, the 2023 E-BIKE Act includes a phase-out plan based on modified adjusted gross income. It lowers the available credit by $100 for every $1,000 people earn over the pre-established income limits. (You can see more about this in the income section above.)

E-Bike Eligibility Requirements

The section explaining qualified electric bicycles also includes some slight changes. The newest version includes tricycles in the wordage and establishes motorized speed limit expectations. It also specifies that the e-bike can only have one motor, meaning recent dual-motor e-bike models would be ineligible.

E-Bike Eligibility Requirements

The section explaining qualified electric bicycles also includes some slight changes. The newest version includes tricycles in the wordage and establishes motorized speed limit expectations. It also specifies that the e-bike can only have one motor, meaning recent dual-motor e-bike models would be ineligible.

Safety Focus

Other additions in the 2023 version prioritize safety regulations. For example, added sections limit eligible e-bikes to ones with UL certification and a VIN from a qualified manufacturer.

Additional Details

The second half of the 2023 bill is entirely new and details the following:

- Special rules, like no double benefits and the option for taxpayers to elect not to receive the credit

- Mirror code tax systems

- The credit transfer process and retailer requirements

How to Claim the E-Bike Tax Credit

Put simply, you can’t claim the e-bike tax credit — not yet, at least. The E-BIKE Act is still just a proposed bill, sitting in the introduction phase in Congress. It will expire at the end of 2024 if no further action occurs.

However, that doesn’t necessarily mean you have to wait around for some version of this federal tax credit to become law. Many states and cities already have credit initiatives in the works.

State and City Tax Credit Initiatives

Local governments are focusing more and more on the transition to electric transportation, thanks, in part, to the National Electric Vehicle Infrastructure (NEVI) Formula Program. Each state is required to submit an annual EV infrastructure deployment plan to the federal government, emphasizing the importance of things like charging stations.

While this requirement prioritizes electric cars and motorcycles, it also opens the door to e-bike infrastructure development. And many states have already considered the importance of e-bikes.

States and cities alike have already rolled out their own tax incentive or rebate programs, helping citizens get their paws on a brand new e-bike! It’s a win-win-win situation if you live in these areas; you save some cash, your city reduces its carbon footprint, and daily traffic jams become more tolerable.

Below is an overview of each state’s e-bike initiatives — or lack thereof. Keep in mind that this is likely not an exhaustive list and many programs may open or close throughout the year. Visit the links provided for more information, or regularly check your local news for the latest updates.

Alabama: There are no e-bike credit or rebate programs in Alabama. The state does, however, offer EV charging station grants and rebates. Alabama Power also provides charger rebates and a special time-of-use rate for both businesses and residents charging EVs.

Alaska: The state currently has no e-bike incentives, only EV rebates and credit programs. The main rebate program occurs through Alaska Power and Telephone (AP&T) for new and used electric cars and motorcycles — just not electric bikes (yet).

Arizona: Although there are no statewide e-bike initiatives, residents of the Tucson metropolitan area can apply for the local e-bike rebate program through Tucson Electric Power (TEP). They can receive a $100 or $600 rebate, depending on income.

Arkansas: Arkansas has only implemented incentives for EVs, not e-bikes. However, the Bentonville City Council received a quarter-million grant in January 2024 to help residents buy e-bikes. The city will set up a lottery system to distribute the funds.

California: The California Air Resources Board launched the first stages of its California E-Bike Incentive Project in 2023. So far, it’s still in the initial stages, accepting only retailer applications.

The final goal is to offer low-income residents a point-of-sale voucher up to $1,000 for a standard e-bike or $1,750 for a cargo e-bike. Qualifying applicants may also receive an additional $250. You can sign up for email updates, so you know when the incentive vouchers become available.

Besides this statewide initiative, there are multiple region-specific rebate programs. Here are a few to consider:

- Alameda: Alameda TMA offers a $300 e-bike rebate for eligible participants until the end of 2024 while funds last. On top of that, Alameda Municipal Power also has its own e-bike rebate program that offers up to $600.

- Contra Costa: County residents who meet income requirements can receive a $500 e-bike rebate through the Contra Costa Transportation Authority. Those who don’t meet the terms can apply for a $150 rebate from 511 Contra Costa.

- Healdsburg: The City of Healdsburg offers incentives up to $700 for e-bike purchases or $50 for an e-bike conversion kit. Income-qualified residents can also receive coupons for the BIRD e-bike share program.

- South Coast (Los Angeles, Orange, Riverside, and San Bernardino): South Coast Air Quality Management District (AQMD) sponsors a Replace Your Ride program that provides residents with up to $9,500 to replace their car with a more environmentally friendly mode of transportation — like an e-bike. The rebate limit will increase to $12,000 soon, once the organization receives the funds.

- Pasadena: The Pasadena Water and Power Department launched a pilot residential e-bike rebate program in July 2023, offering up to $1,000. It was a first-come-first-serve program, and all the funds have already been delegated. You can sign up for related news to see if the program begins again.

- Redding: The City of Redding offers several residential electrification rebates, including a $1,150 voucher for an e-bike, lock, and helmet.

- Richmond/San Rafael: Commuters that use the Richmond-San Rafael Bridge may qualify for up to $1,000 on a new e-bike.

- Santa Barbara: Santa Barbara Clean Energy customers can receive a $200 rebate for any e-bike purchase.

- Santa Clara: Silicon Valley Power customers can apply for a rebate of up to $300. Limited-income applicants may qualify for an extra $200. (Note that this program is only available while funds last, so it may end soon.)

- Monterey, San Benito, and Santa Cruz: Monterey Bay’s E-Bike Incentive Program (e-BIP) provides a rebate of up to $500 for a locally bought e-bike.

- San Mateo: Peninsula Clean Energy started an E-Bikes for Everyone program, offering up to $1,000 to purchase an e-bike. Since this was a first-come-first-serve initiative, it has since ended.

- San Francisco Bay Area: San Francisco Public Utilities Commission customers can get $1,000 toward a new e-bike with the Electrify My Ride program.

Colorado: In 2022, the state passed SB22-193, a bill focused on air quality improvements. Part of that bill specified increased community access to e-bikes through grant and rebate programs. As a result, Colorado enacted a statewide rebate program offering residents up to $1,400 for an e-bike ($800 for moderate-income residents).

The program went through several application rounds, finally ending in February 2024. Unfortunately, the Colorado Energy Office (CEO) does not expect additional funding, so the rebates are no longer available.

However, the Colorado e-bike tax credit starts on April 1, 2024. Residents can receive a $450 point-of-sale discount when purchasing a qualified e-bike.

The CEO is also extending its Can Do Colorado E-Bike pilot program, making it a full-fledged initiative. It expects additional funding to be available in the fall of 2024 to continue implementing e-bike fleets across the state. The goal is to make e-bikes more accessible to low-income residents while improving air quality.

In addition to the statewide initiatives, some cities have organized their own programs.

- Avon: Residents can get a rebate of up to $400 for a new e-bike purchase or $200 for a used e-bike.

- Boulder: Boulder also unveiled an e-bike rebate program in 2023 with two application rounds. While that initiative has since closed, you can still sign up for alerts about upcoming voucher opportunities.

- Cortez: Empire Electric Association awards qualifying customers $150 for a qualifying e-bike purchase.

- Denver: Denver releases e-bike point-of-sale vouchers every other month, offering up to $1,400 in rebates. The last round of vouchers ran out in 20 minutes, showing their incredible popularity.

- Eagle County: While not necessarily a credit or rebate program, Shift Bike is an Eagle County e-bike share program that costs $25 per month or $100 per season for locals.

- Edwards: Residents in the Edwards Metro District can apply for a $200 rebate within six months of purchasing an e-bike.

- Granby: Mountain Parks Electric customers can apply for $150 off an e-bike purchase.

- Gunnison: GCEA customers can apply for several electric power equipment rebates, including a $150 rebate for a qualifying e-bike.

- Holy Cross Energy Service Areas: Holy Cross Energy customers can apply for a $50 rebate for two e-bikes. They can combine this initiative with other local rebate programs.

- Holyoke, Ovid, and Sterling Areas: Highline Electric Association offers up to $150 in rebates for e-bikes, classified as “electric outdoor power equipment”.

- La Plata, Archuleta, and Nearby Areas: La Plata Electric Association also provides residential and commercial e-bike rebates, offering up to $150.

- Vail: The Town of Vail started an e-bike rebate program in 2023, offering up to $500. The program closed after a few months, but you can check the website for updates.

- Yampa Valley: Yampa Valley Electric Association offers an Energy Hero Rebates program. It originally included e-bikes in its list of approved items but then removed them in 2023.

Connecticut: The Connecticut Department of Energy and Environmental Protection (DEEP) created an e-bike initiative program in 2023, allocating $1.5 million for three years’ worth of vouchers. The first round of applications showed the community’s overwhelming interest, and Deep has since increased the funding. Residents can apply for $500-$1,500 rebates.

Delaware: The state does not yet have any e-bike rebates, credits, or initiatives. One might come soon, considering the 2023 Electric School Bus Acquisition Requirement and the ongoing EV rebate.

Florida: There are no active initiatives, but Tampa proposed an e-bike voucher program in 2023. If passed, it would provide people with $500-$2,000 to use on an e-bike purchase at one of the approved retailers.

Georgia: The Atlanta City Council approved an e-bike rebate program in January 2024. Metro residents can receive up to $1,000 for an e-bike (or $2,000 for a cargo e-bike).

Hawaii: Hawaii released a statewide e-bike and e-moped rebate program in 2023. It provides residents with a rebate of up to $500 for an e-bike, provided the applicant is a current student, participates in a low-income assistance program, or does not own a four-wheeled vehicle.

Idaho: Idaho offers no e-bike initiatives and very few EV initiatives.

Illinois: Representative Kam Buckner introduced an electric bike rebate bill in 2023, which has been amended but has not yet passed. The initiative proposes a point-of-sale rebate of up to $2,000, depending on the bike’s cost and the individual’s income level.

Indiana: The City of Bloomington launched an e-bike voucher program at the end of 2023, offering $500-$1,000 to eligible residents registered for Go Bloomington and Zero In Bloomington. The funds are limited, so make sure to check whether the program is still accepting applications.

Iowa: In 2023, Cedar Rapids announced that it was considering a voucher program for low-income families, offering $700 for a regular bike or $900 for an e-bike. Eastern Iowa REC customers can also apply for up to $150 back on their e-bike purchase.

Kansas: The state does not yet offer any e-bike credits or rebate programs, although there are some EV incentives.

Kentucky: In 2022, the Devou Good Foundation gave out $500 e-bike rebates to people in northern Kentucky and Cincinnati, Ohio. With limited funds and high demands, the program lasted only a few months. Considering its success, though, there might be hope for a future statewide e-bike program.

Louisiana: There are no e-bike incentives in Louisiana. The state does offer some EV rebates and incentives, though, including rebates for electric forklifts and golf carts — just not e-bikes.

Maine: In 2023, the governor of Maine signed into law an act that adds e-bikes to the list of electric vehicles eligible for a rebate through Efficiency Maine’s rebate program. However, information about the specific rebate requirements and amounts remains limited.

Regional rebates might become available soon as well. The City of South Portland launched Electrify Everything! in 2022, providing up to $800 in e-bike rebates. The funds ran out in 2023, but you can check for similar local programs.

Maryland: The state is moving forward with an e-bike rebate and voucher program. Even though the first version received an unfavorable report in 2023, Delegate Lewis proposed a new version a few months later that would allocate $100,000 for e-bike vouchers.

Massachusetts: In 2022, Massachusetts passed a bill that would create e-bike rebates of up to $750. The first step, however, was for the Department of Energy Resources to conduct research before rolling out the program. So far, there has been no further movement regarding the rebates, although the administration expects to roll out rebates in 2024.

Income-eligible Cape Light Compact customers can also apply for a voucher and get up to $1,200 towards an e-bike purchase. As of March 2024, customers are on a waitlist, but funding may become available again.

The Worcester E-Bike program has received funding for a second round of applications through March 31, 2024. Residents can apply for a 60-75% e-bike discount, while eligible participants may get a free e-bike.

Michigan: Michigan House Bill 4491 proposes a statewide e-bike incentive program that would offer up to $1,250 in vouchers. While introduced in 2023, the bill has yet to move forward.

At the local level, Ann Arbor released a pilot Community E-Bike Discount program in 2020. It provided a $100 discount and a $50 in-store credit for two e-bike models. Since it was only a pilot program, it has since ended. The city, however, continues to prioritize electric transportation.

Minnesota: The state is launching an E-Bike Rebate program in July 2024. Residents can apply for a rebate certificate of up to $1,500 and then use it at a participating retailer. The legislation only allocated $2 million annually for 2024 and 2025, so the certificates may go quickly. You can sign up for email updates to get the news about when applications open.

Mississippi: The state offers no e-bike initiatives, although there are several EV rebates and support programs.

Missouri: Missouri offers a $2,500 tax credit for electric vehicles, although that does not (yet) include e-bikes.

Montana: There are no e-bike initiatives and extremely limited EV incentives.

Nebraska: Nebraska has no e-bike initiatives and only a few EV incentives.

Nevada: A 2019 report sponsored by the Nevada State government highlighted the need to electrify the state and incorporate better infrastructure to support electric bikes. However, nothing has come of that, and the state still has no e-bike initiatives.

New Hampshire: In 2023, Senator David Watters proposed a statewide e-bike incentive program that would offer up to $600 in rebates for purchasing an e-bike and accessories. Unfortunately, the Commissioner immediately expressed concerns about implementation, and the bill was ultimately killed.

New Jersey: A bill was introduced in 2023 that proposed up to $2,000 in statewide e-bike rebates. However, the bill died in a subcommittee at the beginning of 2024.

New Mexico: Senate Bill 343 proposed statewide e-bike rebates of up to $1,200. However, the bill died in 2023 after just a few days in the Senate.

New York: New York currently has two bills in the legislative approval process. The first is bill S3080A, which aims to establish a Ride Clean Rebate Program like the existing Drive Clean Rebate Program. While the bill passed the Senate in 2022, no further action has occurred to make it law.

The second is 2023 bill S314 (or A275). Like S3080A, this bill proposes a Ride Clean Rebate program. It has yet to pass the Senate or Assembly Committees, though, and may have a similar fate as its predecessor.

Despite the stagnated statewide programs, initiatives in New York City have quickly moved forward. The Charge Safe, Ride Safe program has outlined numerous initiatives for safer electric mobility in the city, and the Department of Transportation has already launched an e-bike charging pilot program.

The Equitable Commute Project also offers an e-bike trade-in program for NYC for eligible delivery workers and some individuals. It offers a significantly discounted rate for a new UL-certified e-bike when you turn in another electric bike, moped, or scooter. People without a trade-in vehicle can apply for an e-bike loan through Spring Bank.

In other areas of the state, e-bike libraries allow residents free, short-term access to electric bikes — much like borrowing a library book. Shared Mobility has helped establish e-bike libraries in areas like Niagara Falls.

North Carolina: The state’s first e-bike initiative occurred in the City of Durham with the Bull E-Bike Pilot. Several residents received an e-bike and accessories to document their experience. Since the program was primarily research-driven, it only lasted a few weeks in 2022.

More recently, the Raleigh City Council authorized the Ral-E-Bike incentive program. It launches in the spring of 2024, providing point-of-sale e-bike vouchers of up to $1,500.

North Dakota: The state offers no e-bike incentives. It is, however, promoting its EV infrastructure program.

Ohio: The Devou Good Foundation offered $500 e-bike rebates to residents of Cincinnati and certain parts of Kentucky. The program quickly expended all the funds due to high demands.

Similarly, Smart Columbus’ 2023 E-Bike Incentive pilot program received an overwhelming amount of applications. The first applicants received their discount vouchers, and the rest were placed on a waitlist. In December 2023, the program received additional funding, but many applicants are still waiting. You can sign up for more updates about the program.

Oklahoma: A 2023 Oklahoma Senate bill proposed a $200 tax credit for e-bike purchases. The bill died in committee, though, just like the first version of the federal E-BIKE Act.

Oregon: Similar to the federal E-BIKE Act, Oregon’s e-bike rebate bill has undergone significant updates since the initial 2022 draft. The current version — presented in 2023 — expands the rebate options to include more people. If passed, it would allocate $6 million for e-bike rebates ranging from $400-$1,200.

At a more local level, the Ride2Own pilot program began in 2023 in Hillsboro, Milwaukie, and Parkrose Neighborhood in Portland. The goal is to give 75 residents a free e-bike, gear, repairs, training, and biking event passes.

EWEB customers in Eugene can also receive a $300 e-bike rebate, while Ashland Electric customers purchasing at a participating bike shop can get $300 for a standard e-bike or $600 for a cargo e-bike.

Other popular regional e-bike initiatives have closed, including the ones in Corvallis and Bend.

Pennsylvania: The state provides no e-bike rebates or tax credits, although there are quite a few EV initiatives. While not specified, e-bikes may qualify for rebates under Pennsylvania’s Alternative Fuels Incentive Grant program — but not if they belong to individuals. Only nonprofits, schools, or other organizations can apply for the $500 rebate for electric scooters, motorcycles, ATVs, and “other low-speed electric vehicles”.

Rhode Island: Rhode Island offers a statewide initiative through the Erika Niedowski Memorial Electrical Bicycle Rebate Program. Residents can apply for a standard rebate of up to $350 or an income-qualified rebate of up to $750. While the initial funds quickly ran out, the state invested another $150,000 in the program in 2023.

South Carolina: There are no e-bike initiatives in South Carolina. The state is slowly moving toward electric transportation, though, with EV charging station initiatives and alternative fuel research grants.

South Dakota: The state offers no e-bike initiatives. State officials have split opinions on e-bikes, as shown in the January 2024 discussion over Senate Bill 56 regarding the use of different e-bike classes on trails. The bill was tabled, awaiting more data.

Tennessee: In January 2023, the Nashville Metropolitan Council received a resolution to reallocate $1 million from the federal COVID funds to an e-bike subsidy program. It proposed offering up to $1,400 for a qualified e-bike purchase. The council repeatedly deferred the resolution, ultimately withdrawing it.

Texas: Austin Energy customers can receive a rebate for an e-bike (or other electric two- and three-wheeled vehicles) purchased within the last 60 days. The standard rate varies between $200 and $600, while residents in the Customer Assistance Program may receive up to $1,300. The incentive program also includes rebates for entire fleet purchases.

Utah: Utah offers no active e-bike incentives, although there were a few recent programs. In 2017, Utah’s Hogle Zoo and Utah Clean Energy launched a ZOOm Go Electric program that offered discounts on EVs and e-bikes.

In 2023, Utah Clean Air partnered with Magnum Bikes to offer 1,000 e-bike vouchers, each worth up to $1,400. Only 1,000 vouchers were available, so the program lasted only a few weeks.

Vermont: Vermont has a statewide e-bike initiative program that provides vouchers of up to $800 to purchase an e-bike. The initiative was relaunched in 2023 and will last as long as funds allow. The 2022 H.552 bill also proposed investing an additional $250,000 in e-bike initiatives, although it has not moved forward.

The Electrify Your Fleet program is a similar initiative but for businesses and organizations. Vermont also offers a Replace Your Ride program that gives individuals up to $5,000 to replace a qualifying flood-damaged vehicle with a greener form of transportation.

VBike even offered the Take It Home program for Brattleboro residents to try an e-bike. The goal was to raise awareness about what all people can do with an e-bike, but the program is on hold until further notice. The E-Bike Lending Library through Local Motion had a similar goal, but it seems that the program is no longer active.

Besides these initiatives, several Vermont utility companies also provide e-bike rebates:

- Burlington Electric Department gives $200 point-of-sale vouchers to Burlington residents to purchase an e-bike from a participating retailer.

- Green Mountain Power offers a $200 rebate for customers switching from fossil fuel vehicles to a commuter e-bike. The incentive applies only to e-bikes purchased in the first half of 2024.

- Stowe Electric Department has offered an e-bike rebate program since 2021. It doesn’t specify the rebate amount, but it applies only to Class 1 e-bikes and will continue through the end of 2024.

- Vermont Public Power Supply Authority offers a $100 rebate that goes toward an e-bike or retrofit kit purchase. It’s unclear if the program has continued into 2024.

- Washington Electric Cooperative gives its members up to $100 toward an e-bike purchase.

Virginia: Virginia has an active statewide EV rebate program. In January 2024, government officials proposed a bill to add an e-bike rebate program that would provide qualifying residents up to $1,100 for an e-bike purchase, plus $100-$300 for required equipment.

The City of Alexandria may also start an e-bike incentive program. After Councilmember Bagley experienced firsthand the perks of an e-bike, she is advocating for widespread e-bike use and better infrastructure.

Washington: In 2023, Washington State passed a transportation appropriations bill that includes an e-bike rebate program. According to the state’s Department of Transportation, the program will include up to $1,200 in point-of-sale electric bike rebates and e-bike lending libraries.

However, the state has not yet enacted it. Various holdups include defining how the process will work, researching other programs, and connecting with e-bike retailers. Over a year-long wait has residents concerned, though, that the bill will never actually launch.

Washington, D.C.: The District Department of Transportation opens applications for e-bike rebates in the spring of 2024. Residents can apply for up to $1,000 for e-bikes, maintenance, and accessories.

goDCgo also offers $700 toward purchasing, repairing, or accessorizing an e-bike (or e-bike conversion kit). As of March 2024, all the vouchers for this round have been distributed.

West Virginia: While the state offers no e-bike incentives, there’s hope for continued change after West Virginia voted to expand e-bike usage laws in 2023.

Wisconsin: The Madison Public Library Foundation established a BCycle Community Pass program where residents can use their library card to borrow an electric bike. The program reopens on March 15, 2024.

Several Wisconsin representatives also introduced Bill 276 in 2023, outlining a proposal for a bicycle tax credit. If approved, the bill would establish up to $200 in credit for bicycles — including e-bikes — purchased for dependents.

Wyoming: There are no e-bike incentives in the state. The Wyrulec Company offers several rebates for electric equipment, like electric lawnmowers and heat pumps. However, it has yet to include e-bikes.

Get Involved

E-bike initiatives are leading the way to an urban transportation revolution. While the lack of movement with the second federal e-bike tax credit is a bit discouraging, the numerous rebate programs nationwide offer some hope.

If your state doesn’t yet offer an e-bike credit — or if you see that recent improvements have paused or died in committees — take action! Reach out to your local government officials, raise awareness about e-bikes’ environmental impact, and sign (or start) petitions.

You can also stay up-to-date with the latest e-bike news by signing up for our eBikes.org newsletter.

Let’s roll towards progress!